Dutch Companies in Hong Kong: Positive Outlook Amid Challenges

Dutch Companies in Hong Kong: Positive Outlook Amid Challenges

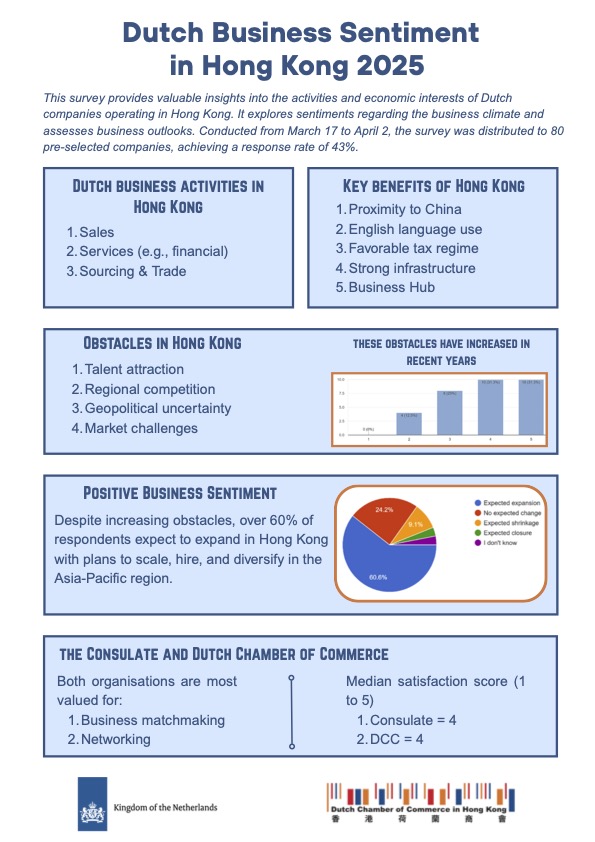

The Dutch Chamber of Commerce in Hong Kong, on behalf of the Consulate General of the Netherlands, recently conducted a survey to gain insights into the activities, economic interests, and business sentiment of Dutch companies operating in Hong Kong. The survey also assessed their outlook on the region’s business climate in the coming years.

Key Findings

Business Activities

The top three business activities of Dutch companies in Hong Kong are:

- Sales

- Services (e.g., financial)

- Sourcing & Trade

This reflects Hong Kong’s continued role as a key commercial and logistics hub for Dutch businesses in Asia.

Business Sentiment & Outlook

- Expansion Plans: Over 60% of respondents expect to expand their business presence in Hong Kong, with many planning to scale up operations, hire more staff, and diversify into the wider Asia-Pacific region.

- Hong Kong’s Strengths: Respondents highlighted Hong Kong’s pro-business environment, citing advantages such as:

- Proximity to Mainland China

- English-language business environment

- Favourable tax regime

- Strong infrastructure

- Status as a regional business hub

Challenges

Despite the positive outlook, companies indicated that obstacles to doing business in Hong Kong have increased over the past three years. Key concerns include:

- Talent Attraction – Difficulty in obtaining suitable staff

- Geopolitical Uncertainty

- Challenges in the Mainland China Market

- Future of the “One Country, Two Systems” Framework

Next Steps

The Dutch Chamber of Commerce and the Consulate General will organise a follow-up session with local authorities and Dutch businesses to discuss the survey findings and explore ways to address challenges while leveraging opportunities.

More details on the event will be announced soon.

For further information, please contact gm@dutchchamber.hk

###########################

About the Survey:

- Conducted among 80 pre-selected Dutch companies in Hong Kong

- Survey period: 17 March – 2 April 2024 (prior to latest US tariff announcements)

- 43% response rate, providing a solid basis for qualitative insights